Luxembourg has one of the most generous retirement systems in the world. On average, pensioners receive 75% of their average salary. In neighbouring countries, this percentage is lower: 58% in France and 44% in Germany. Our retirement age is also lower than that of our neighbours.

Here is everything you need to know about these limits and the renewed debate on the subject at a political level.

At present, contributions collected from the working population are used to fund the pensions paid out to pensioners. This “pay-as-you-go” system is directly impacted by the change in our way of life.

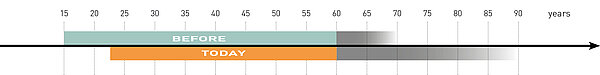

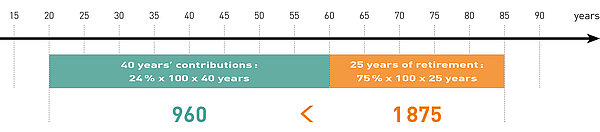

When statutory pensions were introduced, the working population started to work at the age of 15 and retired at 60, so 40 to 45 years of contributions gave way to 5 to 10 years of pension. Today, a young person starts their career at an average age of 20 to 25 and life expectancy has increased. 25 to 30 years of retirement must therefore be funded with the help of only 35 years of contributions.

How has the system managed to hold up so far?

Significant growth of the working population has meant the system has not yet reached its limits. Until present, the sum of the contributions deducted from the working population is higher than the number of pensions paid out to pensioners. It was therefore possible to accumulate a certain reserve over time.

From 2027, that will no longer be the case. The amount of pensions paid out will be higher than the amount of contributions, meaning it will be necessary to start drawing on this reserve.

And from 2047, the reserve will be completely exhausted.

For the current system to continue, the working population would have to triple by 2070... which is unrealistic and would also exacerbate other problems, such as housing.

The political leaders therefore face major challenges when it comes to ensuring the long-term sustainability of the statutory pension system. There is no doubt that developments in this area are to be expected.

To anticipate these changes and secure your retirement, you can take matters into your own hands.

There are several solutions to help you prepare for your future and to start building up a supplement which will prove particularly useful at a later point in time. Individual insurance policies such as easyLIFE Pension are a fantastic way to reach this goal. Plus, they are tax deductible and give you tax savings every year.

Solutions for the self-employed and for companies are also available. This gives everyone suitable options and they can take action based on their means, to help tackle the pension challenge.

Ask your LALUX insurance agent for advice, they’ll be delighted to help you!